A closer look at 3 measures just approved by Georgia voters

ATLANTA, Ga. (WRDW/WAGT) - Georgia voters approved three ballot measures aimed at taxes and property values.

One of the measures with the most would cap property taxes. According to the Department of Revenue, between 2018 to 2022, the total assessed property value in Georgia increased by 40%.

LIVE UPDATES: Election 2024 across the CSRA and beyond

Get a look at the latest election coverage from News 12, updated continuously throughout the day.

Georgia Amendment 1 is called the Local Option Homestead Property Tax Exemption Amendment. This constitutional amendment would allow the state legislature to implement a statewide local-option homestead exemption from ad valorem taxes. It would apply to every county, consolidated government, municipality or local school system beginning January 1, 2025.

A homestead property tax exemption reduces the amount of property taxes that a homeowner owes on their residence.

Why did Georgians vote the way they did? AU expert weighs in

We spoke to William Hatcher, a professor of public istration at Augusta University who says many people voted with their wallets.

Emory University professor Usha Rackliffe said this will help existing homeowners and suggests they may stay in their homes longer. She feels it’s a good measure, but some school districts may suffer without the funding.

“Half of Georgia’s property tax revenue goes to fund the school systems. So it’s a really key source of revenue. And so you can’t afford maybe to have a decrease in the revenue for all of those people,” said Rackliffe.

In a related measure, Georgia Referendum A, or the Personal Property Tax Exemption Increase Measure, will increase the personal property tax exemption from $7,500 to $20,000 on January 1st, 2025.

Rackliffe said it will help small business owners the most.

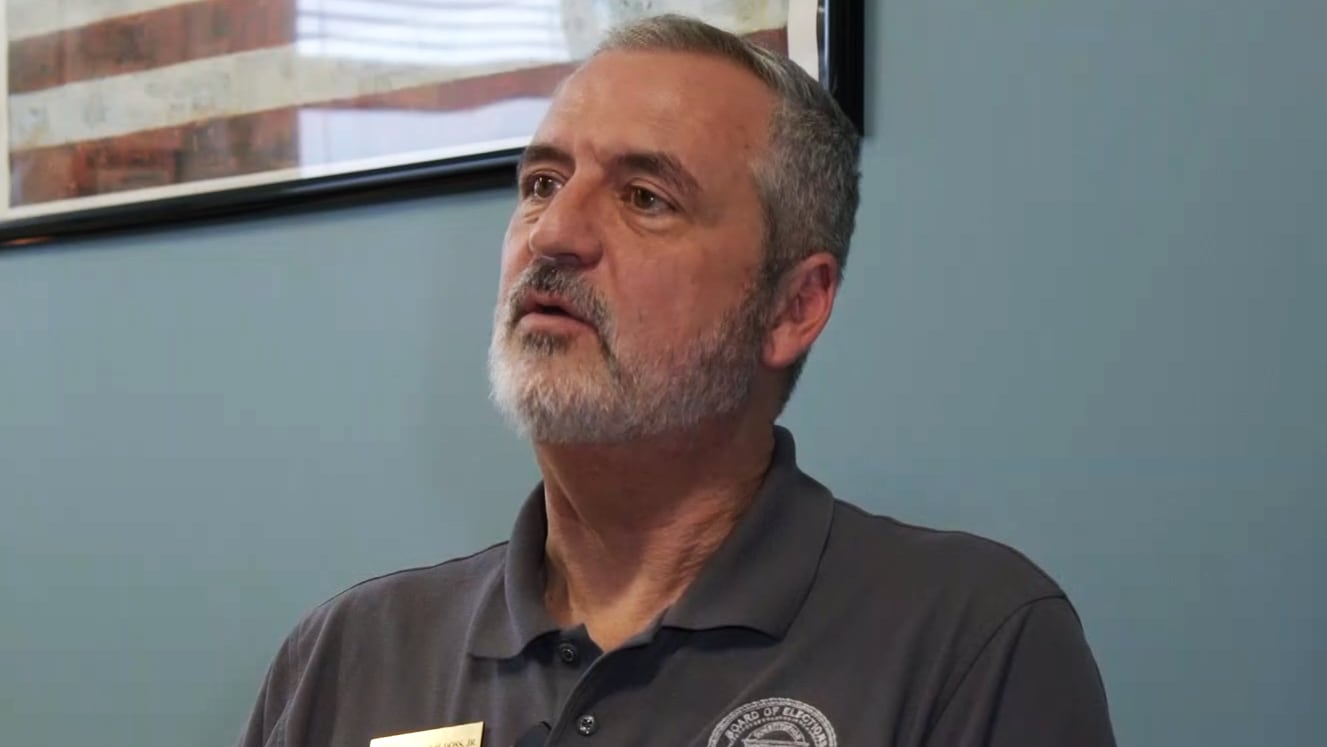

How election night went, according to Richmond County Board of Elections

We spoke with Richmond County Board of Elections officials on how they thought the night went.

“If you talk to a small business owner, they will tell you $7,500 doesn’t for very much. Maybe it s for a couch and two chairs, a table, and a couple of chairs. It’s just keeping up with inflation. Costs have gone up so much, so $7,500 doesn’t amount to a whole heck of a lot these days anyway,” said Rackliffe.

Constitutional Amendment 2 narrowly ed for the creation of the Georgia Tax Court that will rule on tax disputes between businesses and the Georgia Department of Revenue.

Currently, Georgia has a tax tribunal, which is not a part of the state judicial system.

Copyright 2024 WRDW/WAGT. All rights reserved.